Google parent company, Alphabet, is coming for Nvidia in one of the world’s most lucrative hardware markets.

This day was inevitable. Hyperscalers like Alphabet (GOOG +0.29%)(GOOGL +0.29%), Amazon, and Microsoft have spent billions of dollars designing their own data center chips for artificial intelligence (AI) workloads, but until now, their hardware didn’t hold a candle to Nvidia‘s (NVDA +0.88%) industry-leading graphics processing units (GPUs).

On Nov. 18, Alphabet launched its new Gemini 3 AI model. It was quickly recognized as one of the best in the industry, delivering greater performance than the latest models from leading start-ups OpenAI and Anthropic. But here’s the real story: Gemini 3 was trained exclusively on Alphabet’s specially designed tensor processing units (TPUs) for the data center, so this could mark the beginning of the end of Nvidia’s dominance in the market for AI chips.

In fact, Meta Platforms is now reportedly in talks to buy TPUs directly from Alphabet, and Anthropic recently announced plans to expand its adoption of these chips through Google Cloud. What should Nvidia investors do?

Image source: Alphabet.

Google’s TPUs are in high demand

Google Cloud operates a number of centralized data centers fitted with AI chips, including thousands of its own TPUs in addition to Nvidia’s GPUs. Like most cloud providers, it rents the computing capacity to other businesses who use it to develop their own AI software, and this has become a very lucrative practice.

During the third quarter of 2025 (ended Sept. 30) alone, Google Cloud generated $15.1 billion in revenue, which was up 33.5% from the year ago period. That growth rate actually accelerated from the previous quarter. The cloud computing platform’s revenue could be growing even faster, but demand for TPUs is growing more quickly than Alphabet can possibly supply them; in fact, its order backlog surged by 82% year over year to $155 billion during the third quarter, from customers who are waiting for more capacity to come online.

Amin Vahdat, who is the general manager of AI and infrastructure at Google Cloud, says this supply demand imbalance could last for the next five years. This could give the platform incredible pricing power and significantly boost its revenue and profitability, but it’s unfortunate for AI developers who need access to computing capacity today.

In late October, Anthropic announced plans to access up to 1 million TPUs through Google Cloud to train its flagship Claude AI models. That is just one customer, so it highlights the sheer scale of the potential demand for these chips. Meta Platforms, which currently relies on Nvidia’s GPUs to train its Llama AI models, is reportedly planning to buy billions of dollars worth of TPUs starting in 2027, which it will install in its own data centers.

When developers specifically demand TPUs through Google Cloud, that reduces demand for Nvidia’s GPUs because Alphabet simply doesn’t need to buy as many. However, selling TPUs directly to third parties is far more threatening to Nvidia’s business model, because it means any developer with its own data centers could now also be a potential customer — and they tend to be very big spenders.

Today’s Change

(0.29%) $0.92

Current Price

$315.81

Key Data Points

Market Cap

$3811B

Day’s Range

$313.91 – $318.38

52wk Range

$140.53 – $328.83

Volume

36M

Avg Vol

38M

Gross Margin

59.18%

Dividend Yield

0.26%

Nvidia stock might still be a great buy

If order backlogs for computing capacity continue to grow, then Nvidia probably won’t feel the effects of the increasingly competitive semiconductor market for several more years. Even if cloud providers like Alphabet believe their chips are superior, they will have to continue sourcing chips from third parties like Nvidia if they want to fill demand from their customers. Otherwise, those businesses and developers will simply flock to other providers.

Plus, GPUs are still the gold standard for most AI workloads because of their versatility. Alphabet designed its TPUs for its own purposes, and while they are increasingly performant and energy efficient, they won’t necessarily be the best choice for every developer. Nvidia still has the dominant full-stack ecosystem featuring its proprietary CUDA software, which is the programming language most of the AI industry’s top developers have used for years. Switching hardware means abandoning CUDA, because it only works with Nvidia’s chips.

Further, Nvidia CEO Jensen Huang thinks AI data center spending could reach a staggering $4 trillion annually by 2030. For some perspective, Nvidia is on track to generate $213 billion in revenue during its current fiscal year (which concludes at the end of January), so Huang’s forecast leaves plenty of room for growth, even if the company loses its position as the market leader.

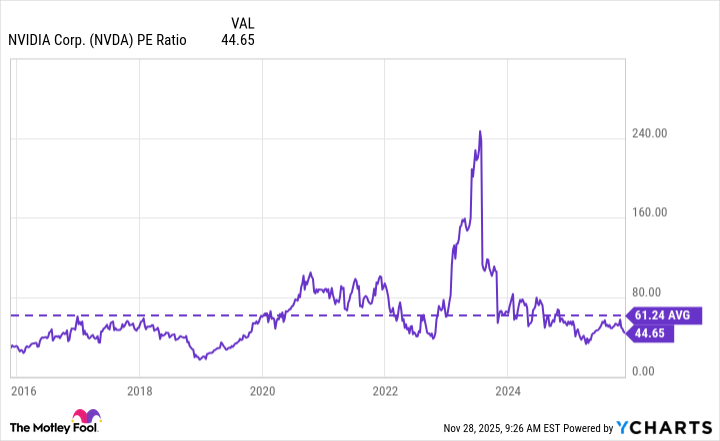

On that note, Nvidia stock is trading at an attractive valuation relative to its history. Its price-to-earnings (P/E) ratio is 44.6, which is a 37% discount to its 10-year average of 61.2. From that perspective, it might be a great buy right now for investors who are willing to hold onto it for the next five years.

NVDA PE Ratio data by YCharts

Alphabet stock is also quite attractive, despite its eye-popping 70% return this year. Its P/E ratio is just 31.2, which actually makes it slightly cheaper than the Nasdaq-100 index.

Since AI infrastructure spending is expected to broadly continue ramping up, it might be a good strategy to own shares in both companies.