Stock market gains have resulted in one problem for investors.

The S&P 500 has been flying high over the past few years amid investor optimism about artificial intelligence (AI) companies and an easier interest rate environment ahead. This helped the famous benchmark advance in the double-digits during each of the past two years, and this year, it’s on track for another similar increase.

Investors have been excited about AI because it has the potential to revamp how companies work. By streamlining tasks, they may cut costs and supercharge growth, and AI also has what it takes to power discoveries. All of this is great news for earnings and stock performance — and investors have been eager to get in early on this opportunity.

Meanwhile, the Federal Reserve started lowering interest rates last year and resumed action this fall, with cuts in September and October. Investors like this trend because lower rates support spending and make it easier for companies to borrow, all of which is favorable for growth-oriented companies.

While this sounds fantastic, trouble may be brewing under the surface — and one particular piece of evidence puts it on display. The stock market just flashed a signal we’ve seen only once before, and here’s what history says could come next.

Image source: Getty Images.

Nvidia and Palantir soar in the quadruple-digits

Before checking out this major clue, let’s consider the momentum we’ve seen recently in the stock market. As mentioned, technology stocks involved in AI have powered gains, with names like Nvidia and Palantir Technologies advancing in the quadruple-digits over just a few years. And companies offering AI chips for rent through their cloud platforms have seen their prices explode higher. For example, CoreWeave and Nebius Group have advanced nearly 100% and more than 200%, respectively, this year.

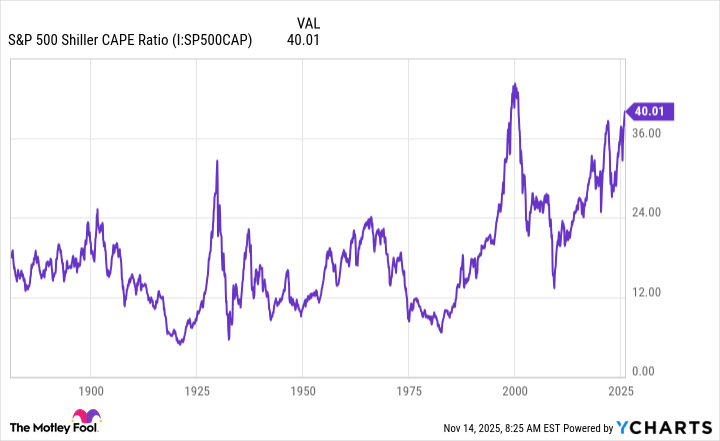

All this is good news if you happen to be a shareholder, but excessive gains could lead to one thing we’ve seen unfold in recent months: Stocks have become more expensive. This brings me to the stock market signal we’ve seen only once before, and it has to do with the S&P 500 Shiller CAPE (cyclically adjusted price-to-earnings) ratio.

Stock price and earnings over time

This metric offers a solid valuation picture because it considers stock price and earnings over 10 years, accounting for fluctuations in the economy. The Shiller CAPE ratio just surpassed the level of 40, something it hasn’t done since the dot-com bubble took shape back in 1999. That was the only other time it reached this level in the S&P 500’s entire history — whether you consider its existence as a 500-company index since the late 1950s or its earlier forms.

Now, the question is: What comes next? History shows us that after valuations have reached peaks — such as during the dot-com bubble — the S&P 500 has gone on to decline. For example, from December 1999 through December 2001, the S&P 500 slid about 20%. In November 2021, when the S&P 500 Shiller CAPE ratio surpassed 38, the index fell 20% in the following 12 months.

Clues from history

Now, considering that message from history, should we brace for a fall, especially considering the current mood in the market? As we’ve seen in recent days, investors have worried about an AI bubble taking shape, and that’s led to declines in tech stocks as well as the overall market. For example, on Friday, the S&P 500 posted its worst performance in a month.

While it’s very likely a more prolonged period of declines will come at some point — the market never rises continually forever — we don’t know when it will happen. And we don’t know exactly how much the S&P 500 will retreat.

But this dark cloud offers us a silver lining. Tech earnings have been strong — from leaders such as Palantir and Amazon, among others — and these players have spoken of ongoing demand for AI. All this supports the long-term AI growth story, suggesting a dip in prices of quality players may be a buying opportunity.

Finally, most important of all, history also tells us that declines never last forever, and the S&P 500, as well as great companies, always recover and go on to deliver a win, and this is fantastic news for long-term investors.